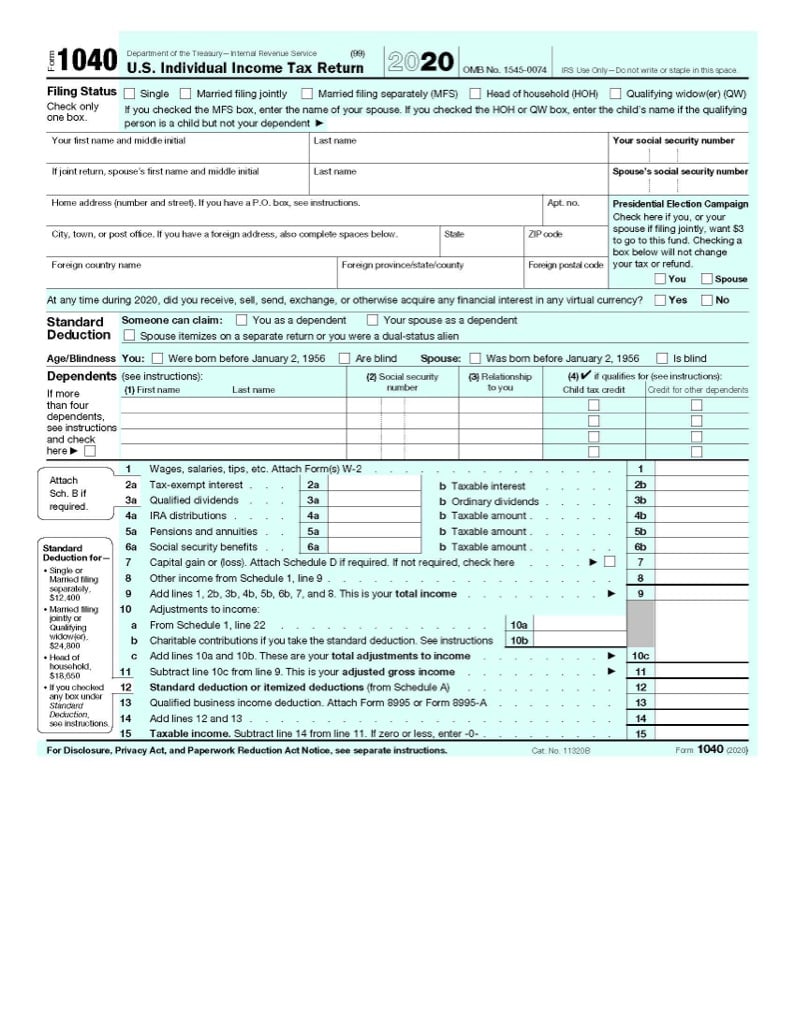

2024 Schedule A Itemized Deductions Form – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, .

2024 Schedule A Itemized Deductions Form

Source : www.investopedia.comA1O04 Form 1040 Schedule A Itemized Deductions NelcoSolutions.com

Source : www.nelcosolutions.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comWho Should Itemize Deductions Under New Tax Plan | SmartAsset

Source : smartasset.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govSchedule A (Form 1040) Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comWhat Is Schedule A of Form 1040?

Source : www.thebalancemoney.comItemized Deductions & Schedule A (Form 1040) Jackson Hewitt

Source : www.jacksonhewitt.com2024 Schedule A Itemized Deductions Form All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . For a taxpayer whose itemized deductions are less than indicate that you want to itemize your deductions using Schedule A. You will want to verify the amount of property taxes paid to be .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-e2490b265c7e42d1b79c9d70835003fd.png)